|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

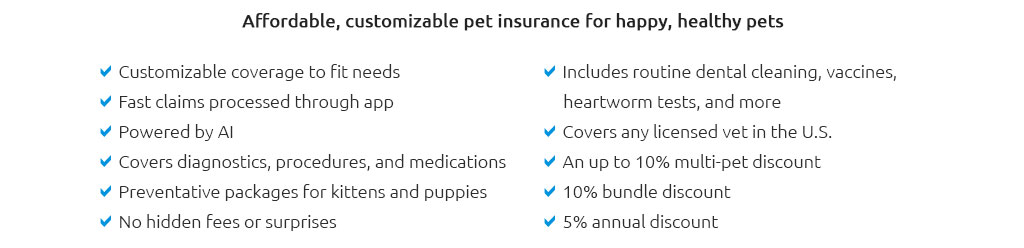

Understanding the Intricacies of 2 Cat InsuranceAs a devoted feline enthusiast, you know the joys and challenges of having not just one, but two furry companions. With this joyful commitment comes the responsibility of ensuring their health and well-being, which is where 2 cat insurance becomes a pivotal consideration. The market is burgeoning with options, each claiming to offer the best protection for your pets. So, how do you navigate these waters to find the optimal policy that caters to both your cats’ needs? The first step in this journey is understanding what 2 cat insurance entails. At its core, it provides financial coverage for veterinary expenses that might arise unexpectedly. This can include anything from regular check-ups to emergency surgeries, which can otherwise place a significant burden on your finances. By insuring both cats under a single policy, you might not only streamline the management of their healthcare but also potentially benefit from multi-pet discounts offered by many insurers. Choosing the right insurance plan requires careful consideration of several factors. Begin by evaluating the specific needs of your cats. Are they indoor or outdoor cats? Do they have any pre-existing conditions? These questions will help you tailor a policy that adequately covers potential health risks. Moreover, it's important to scrutinize the fine print of any policy you consider. Look for coverage limits, exclusions, and the flexibility of the insurer in covering chronic conditions or hereditary diseases. Another pivotal aspect is understanding the reimbursement process. Most insurance plans work on a reimbursement basis, meaning you’ll need to pay the vet upfront and later claim the cost from the insurer. Check how swiftly and seamlessly the insurer processes claims and whether they require extensive documentation, which could prolong reimbursement. The financial side of the equation cannot be overlooked. The premium for insuring two cats can vary widely based on several determinants including their age, breed, and health status. It's prudent to compare different policies and consider the cost versus the coverage offered. A higher premium might offer more comprehensive coverage, but it's crucial to ensure it aligns with your budget. Ultimately, the goal of acquiring 2 cat insurance is peace of mind. It’s about ensuring that, when your feline friends need medical attention, financial constraints don’t compromise their care. By being diligent and informed in your choice, you can rest assured that your beloved pets are protected. FAQs about 2 Cat InsuranceWhat is the benefit of having insurance for two cats under one policy? Having both cats under a single policy can simplify management and potentially reduce costs through multi-pet discounts. Are there specific conditions that are usually not covered by cat insurance? Many policies exclude pre-existing conditions, routine check-ups, and hereditary conditions, so it's vital to review policy details. How do insurers determine the premium for 2 cat insurance? Premiums are typically based on factors like the cats' age, breed, health status, and lifestyle (indoor vs. outdoor). Is it possible to change my policy as my cats age or their health needs change? Many insurers allow policy adjustments; however, it's crucial to confirm this flexibility when choosing a plan. https://www.lemonade.com/pet/explained/multiple-pet-insurance/

But one thing to remember: If you take two or more of your pets to the same vet for a covered treatment at the same time, you'll still need to file claims ... https://www.gocompare.com/pet-insurance/multi-pet/

Multi-pet insurance allows you to cover more than one animal under the same policy. Usually, you get a discount by adding multiple pets to a single insurance ... https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

Each plan had a $250 deductible, $5,000 in annual coverage and an 80% reimbursement rate. Dogs. Age 2: $36/month. Age 8: $67/month. Cats. Age 2: ...

|